Wall Street’s fickle pendulum when it comes to the Federal Reserve has swung more decisively toward expectations for a December rate cut. The market-implied probability for a reduction at the December meeting of the Federal Open Market Committee rose to 62.4% on Monday, according to the CME Group’s FedWatch measure of 30-day fed funds futures contracts. Faced with worries over inflation and the uncertainty regarding President-elect Donald Trump’s policies , traders a week ago had taken the possibility down to around a coin flip. However, the tilt now is that the Fed will follow through on its September and November cuts with one more to close out a busy 2024. “In terms of getting into the details of the risks, December itself is a close call,” Aditya Bhave, senior U.S. economist at Bank of America, said Monday on a call with reporters. “It’s going to depend on Friday’s jobs data. It’s going to depend on the inflation data. We think that the Fed wants to do this cut in December.” “You know, they’ll never talk about politics, but it does make sense. Before there are any policy changes, they truly believe that there is more room to recalibrate,” he added. In remarks on Monday, Fed Governor Christopher Waller backed up the sentiment that a cut is likely , though he expressed misgivings about where inflation is headed. Recent data has shown prices ticking higher and further away from the central bank’s stated 2% annual goal. “As of today, I am leaning toward continuing the work we have started in returning monetary policy to a more neutral setting,” Waller said. However, he noted that if inflation data continues to show signs of “stalling,” he will “be supportive of holding the policy rate constant.” The Fed currently targets its benchmark overnight borrowing rate in a range between 4.5% and 4.75%. That follows cuts in September and November that took the fed funds rate down by three-quarters of a percentage point altogether.

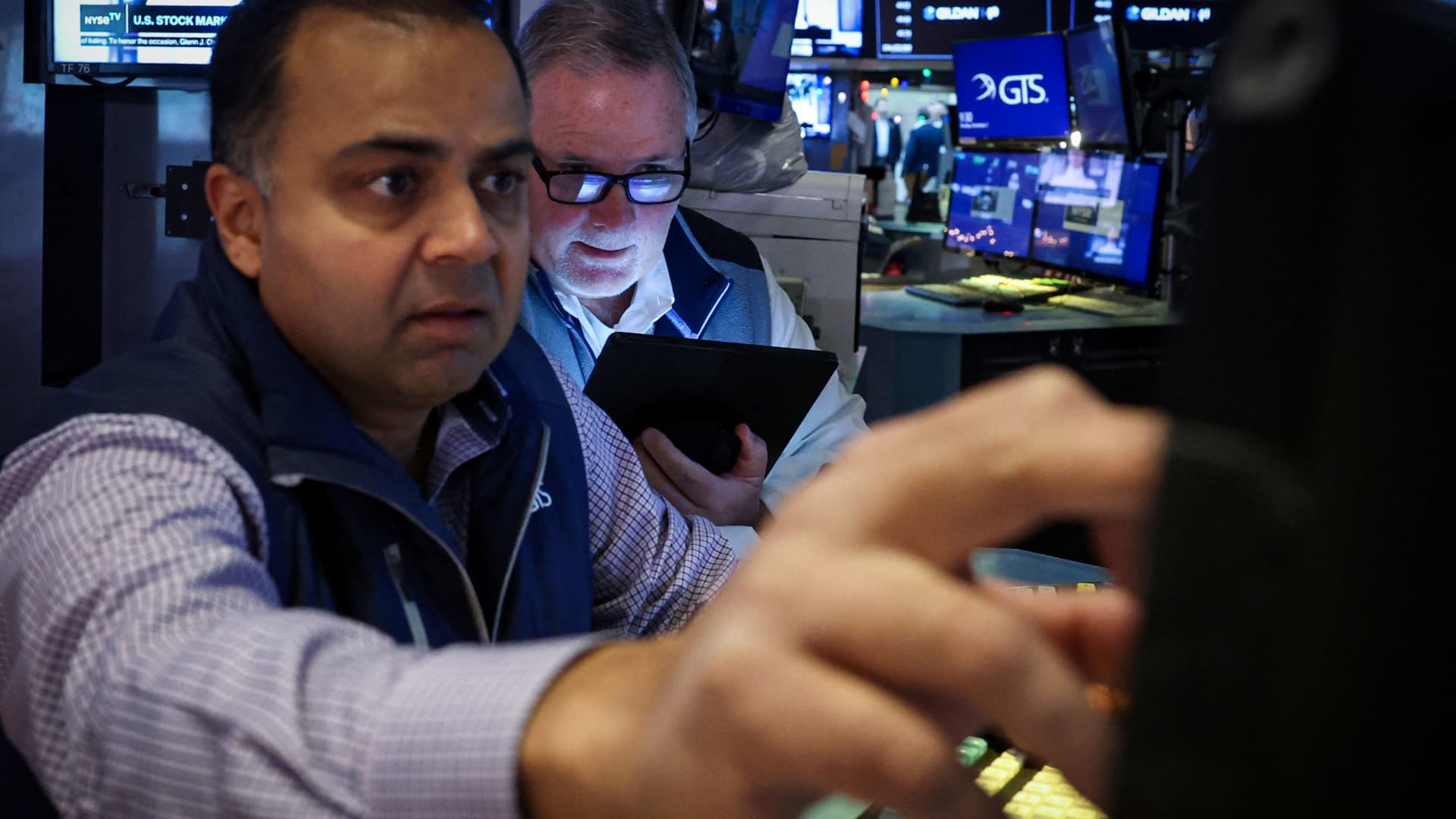

Markets are getting comfortable again with idea of December rate cut