The market rally may experience a hiccup in the beginning of 2025 as signs of froth are appearing in the market. “For the here and now, there may be too many charged up bulls,” Yardeni wrote in a Thursday note. “Contrarian indicators are turning bearish, suggesting the new year might start with a stock market pullback,” he added. Yardeni expects any pullback will likely be short lived, which could present an opportunity for investors to buy in. To support his view, the investor pointed to indicators such as the Investors Intelligence Bull/Bear Ratio, which has jumped to 3.9 from 2.3 in mid-October. When the ratio rises above 4, it is seen as a sign that much of the good news in the market has already been priced into stocks. The S & P 500 is also trading 11.2% higher than its 200-day moving average, with financials in particular appearing “overextended,” per Yardeni. In addition, “The Conference Board’s November Consumer Confidence Index (CCI) survey showed a record 56.4% of consumers expect stocks to be higher in the next 12 months. … That’s even more bullish than ahead of the tech wreck in 2000,” he added. Yardeni remains optimistic about the market through the end of the decade. “We think the Roaring 2020s could turn into the Roaring 2030s,” Yardeni said.

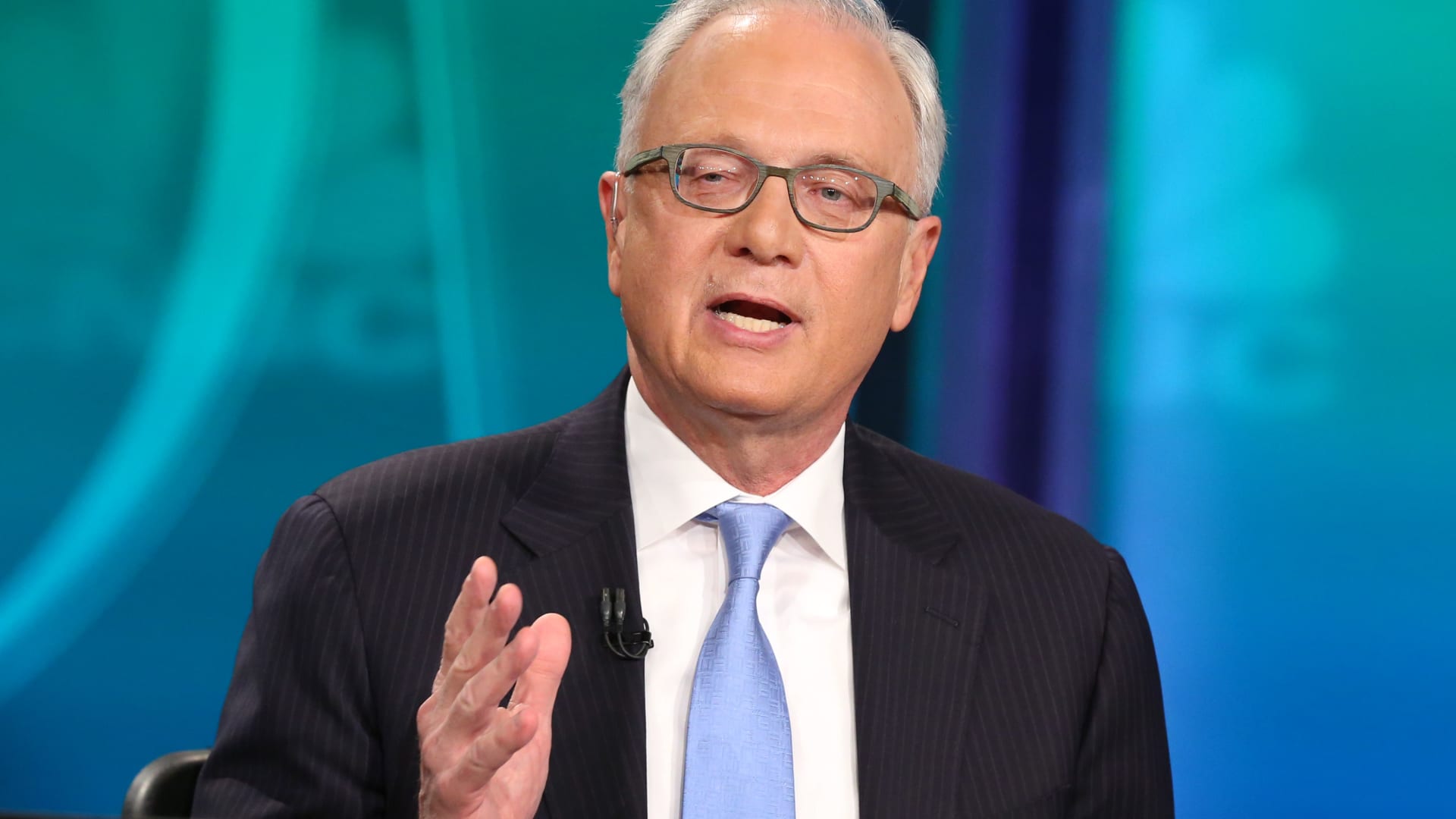

Ed Yardeni says there may be a pullback to start 2025