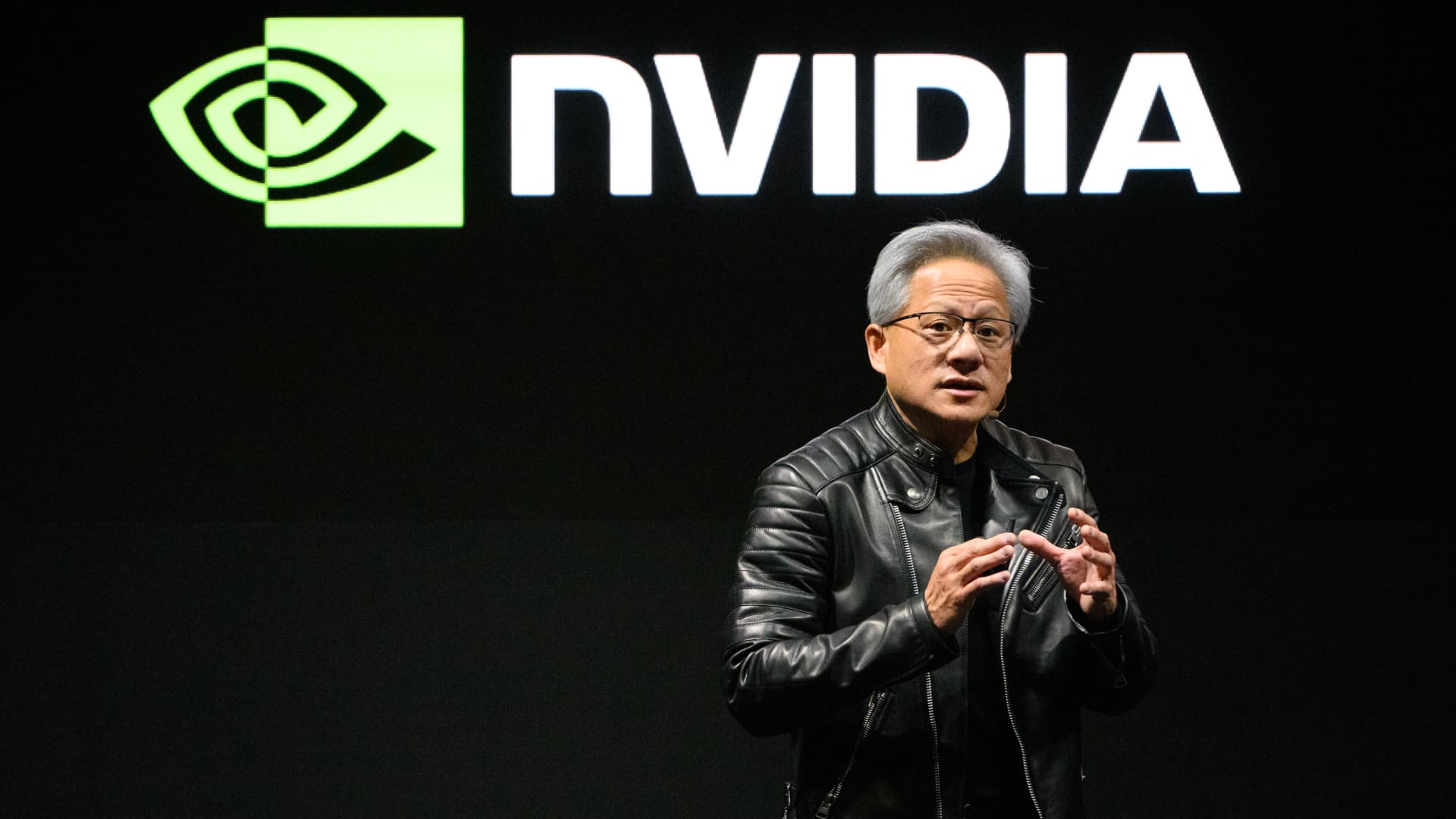

Chip stocks have been one of the premier trades on Wall Street over the last two years. If the first few trading days of 2025 are any indication, the group’s strength is likely to continue. The VanEck Semiconductor ETF (SMH) is already up 4% in January. Last year, the fund climbed 38.5% — adding to its 72.3% surge in 2023. Artificial intelligence darling Nvidia was also up 7.6% in the first two trading days of the new year, after sliding 2.9% in December. The group got a boost early Monday after Taiwan’s Foxconn reported record fourth-quarter revenue. Nvidia shares were up more than 2% in the premarket, while Broadcom and Micron Technology advanced 1% and 5.2%, respectively. The SMH popped 2.6%. Semiconductor stocks, despite their overall strong 2024 performance, are coming off a sluggish month, ending December flat. SMH mountain 2022-12-30 SMH since 2023 Semiconductors could also get a boost later on Monday after Nvidia chief Jensen Huang delivers an address at the Consumer Electronics Show in Las Vegas. There are “a lot of expectations that maybe Jensen will tease a little bit about the AI robotics strategy, maybe we will get some more granularity on the Blackwell [chip] ramp … also gaming and some other aspects of the business,” Wedbush analyst Joel Kulina told CNBC’s Frank Holland on Monday’s ” Worldwide Exchange .” “But clearly the bulls want to hear some color on how Blackwell is going so far in terms of supply and demand.” Bottom line: Investors appear to be betting that AI momentum will continue to grow in 2025, which will lead to greater demand for high-power chips and strong profits for semiconductor names. Higher semiconductor stocks are boosting index futures to start the week. Dow Jones Industrial Average futures climbed about 200 points, while S & P 500 and Nasdaq-100 futures rose 0.8% and 1%, respectively. To be sure, trading could be choppy during this shortened trading week as investors navigate a key U.S. jobs report due on Friday, one day after a national day of mourning for former President Jimmy Carter on Thursday, and as corporate earnings season looms. Elsewhere on Wall Street on Monday, TD Cowen upgraded American Airlines to buy from hold and set a Wall Street-high price target of $25 on the stock. That implies upside of 47% over the next 12 months. “AAL has emerged from transitory 2024 challenges (vs more structural challenges for LCCs/ULCCs),” analyst Tom Fitzgerald wrote, referring to low cost and ultra low cost carriers. “Tailwinds include better domestic pricing, regaining biz traffic, & improved credit card economics. We view consensus estimates as too low given tailwinds and favorable comps through 2025.”

Why chip stocks are booming in early 2025 after December sluggishness